HERITAGE PARTNERS ARE WORKING TO BRING A STATE HISTORIC TAX CREDIT TO IDAHO

PROPOSAL

A state Historic Tax Credit (HTC) program to incentivize the rehabilitation of historic properties. Developed by the Idaho State Historical Society and Preservation Idaho, in consultation with the Idaho Department of Commerce and the Idaho State Tax Commission. The program would complement and amplify the benefits of the existing Federal Historic Tax Credit program.

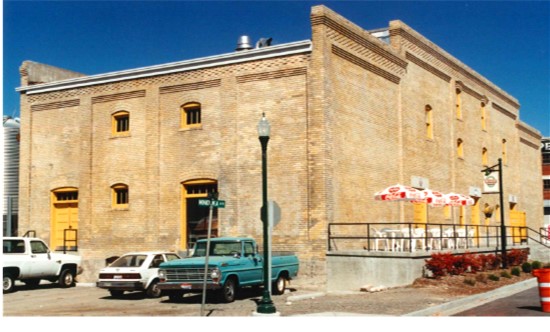

PROJECTS in idaho THAT HAVE BENEFITED FROM FEDERAL HISTORIC TAX CREDITS

WHY CREATE A STATE HISTORIC TAX CREDIT?

Rehabilitation Tax Credits are a proven economic stimulus tool implemented in some form in 35 of the 50 states. For example, Texas created a state historic tax credit despite having no income tax

An Idaho HTC would amplify the federal program; The Federal Rehabilitation Tax Credit was one of only a handful of tax credits to be retained in the Tax Cuts and Jobs Act passed by Congress in 2017 (Public Law no. 115-97), recognizing the program’s significant positive economic impact

It is a business tool. Without a complementary state tax credit, federal HTC projects often can’t ‘pencil out.’ As a result, hard-to-redevelop projects remain vacant while draining local resources and depressing property values. Rehabilitation and Adaptive Reuse brings these properties back onto the tax rolls at a higher value while stimulating job creation and economic growth for their communities

Economic impact studies show $1 in state tax credit can bring $4 in private investment when structured as proposed for Idaho. In most cases, more than 1/3 of a state’s pending tax credit disbursement is recouped during the construction period through state taxes on construction labor and materials, before the building is placed in service and any tax credits are issue.

Sales tax and payroll tax revenue both increase during construction and become more permanent as income-generating tenants move into the rehabilitated commercial buildings

Rehabilitation of existing buildings is generally more labor-intensive and less material intensive, putting more money back into the local economy. Local workers have more buying power and materials are more often sourced locally, benefiting Idaho businesses (by contrast, new construction more frequently sources materials out of state or overseas). Avoiding demolition keeps building material out of the landfill

Abandoned or underperforming buildings are placed back onto tax rolls and the increased property values support local services and school districts

Proposal basics for Idaho’s HTC- (These are not final details. The specifics are still being discussed. These are the types of components found in many state htc programs):

Eligible properties are those certified as historic by the State Historic Preservation Office (SHPO)

Minimum $20,000 investment is required

After certified historic rehabilitation is complete, the applicant can deduct the equivalent of 20% of the total certified rehabilitation costs from their state income tax liability

Can be carried forward up to 5 years

Can be transferred to another entity with Idaho state tax liability

Built-in per-project cap

5-year owner-holding period, with recapture clause same as the federal historic tax credit